Why a Secured Credit Card Singapore Is Important for Structure Your Credit History

Decoding the Refine: Just How Can Discharged Bankrupts Obtain Debt Cards?

The process of restoring debt post-bankruptcy postures special difficulties, usually leaving many questioning regarding the expediency of acquiring credit cards once again. Exactly how precisely can they navigate this detailed process and protected credit report cards that can assist in their credit restoring journey?

Comprehending Charge Card Qualification Standard

One key element in credit card qualification post-bankruptcy is the person's debt score. A higher credit scores score signals liable financial behavior and might lead to better credit history card alternatives.

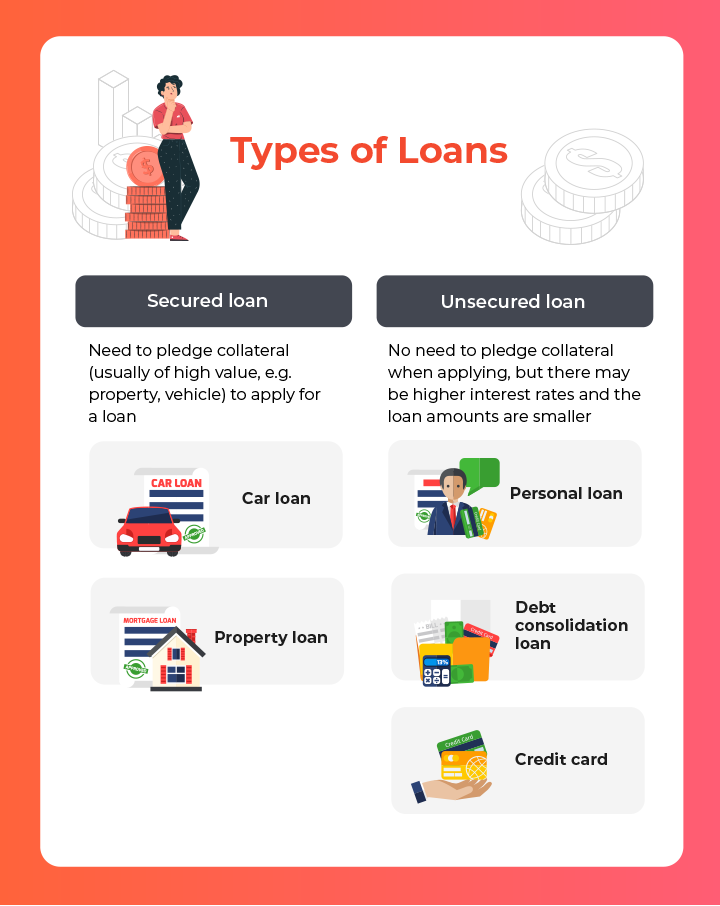

Moreover, people must know the different types of bank card readily available. Secured charge card, for instance, require a money down payment as security, making them much more obtainable for people with a history of bankruptcy. By recognizing these qualification requirements, individuals can browse the post-bankruptcy credit landscape better and work towards rebuilding their economic standing.

Rebuilding Credit Rating After Personal Bankruptcy

After personal bankruptcy, people can begin the procedure of rebuilding their credit to boost their economic stability. One of the first action in this process is to get a safe charge card. Secured credit history cards call for a cash down payment as security, making them more easily accessible to people with a bankruptcy history. By utilizing a safeguarded credit card properly - making prompt repayments and maintaining balances low - people can demonstrate their credit reliability to possible lending institutions.

One more approach to reconstruct credit scores after bankruptcy is to come to be a certified user on a person else's bank card (secured credit card singapore). This allows people to piggyback off the primary cardholder's favorable credit rating, potentially enhancing their own credit rating rating

Consistently making on-time repayments for financial obligations and bills is important in restoring credit report. Settlement history is a considerable element in figuring out credit report, so demonstrating liable financial actions is necessary. Furthermore, routinely checking credit history records for errors and mistakes can aid ensure that the info being reported is correct, additional helping in the credit rebuilding process.

Secured Vs. Unsecured Credit Report Cards

When considering credit rating card choices, individuals might encounter the option in between safeguarded and unsecured credit history cards. Secured credit score cards require a cash money down payment as collateral, generally equivalent to the credit rating limitation approved. While safeguarded cards offer a path to improving credit report, unprotected cards provide more adaptability but may be more difficult to acquire for those with a distressed credit history.

Requesting Debt Cards Post-Bankruptcy

Having talked about the differences between unsecured and secured bank card, people who have undertaken insolvency may now consider the process of requesting charge card post-bankruptcy. Reconstructing credit score after personal bankruptcy can be difficult, but obtaining a charge card is an important step towards boosting one's creditworthiness. When looking my link for debt cards post-bankruptcy, it is necessary to be strategic and careful in picking the best options.

Furthermore, some people might get certain unprotected bank card particularly created for those with a background of bankruptcy. These cards might have greater fees or rates of interest, yet they can still provide an opportunity to reconstruct credit rating when utilized sensibly. Prior to looking for any kind of bank card post-bankruptcy, it is recommended to evaluate the conditions carefully to understand the charges, rates of interest, and credit-building possibility.

Credit-Boosting Strategies for Bankrupts

For people looking to improve their credit score scores after bankruptcy, one vital strategy is to get a protected credit history card. Secured cards call for a money down payment that offers as collateral, making it possible for individuals to show accountable credit history usage and payment actions.

Another approach involves coming to be an authorized customer on somebody else's bank card account. This allows people to piggyback off the key account holder's favorable credit rating, potentially boosting their own credit rating. Nonetheless, it is essential to make certain that the main account owner maintains great credit practices to make the most of the benefits of this approach.

Additionally, constantly monitoring credit history records for errors and disputing any kind of mistakes can also aid in enhancing credit score ratings. By remaining their website aggressive and disciplined in their credit history administration, people can progressively boost their credit reliability also after experiencing personal bankruptcy.

Final Thought

Finally, discharged bankrupts can get bank card by fulfilling eligibility requirements, reconstructing debt, understanding the difference between safeguarded and unsafe cards, and using purposefully. By adhering to credit-boosting strategies, such as maintaining and making prompt repayments credit score application reduced, insolvent individuals can progressively improve their creditworthiness and access to bank card. It is necessary for web released bankrupts to be mindful and diligent in their economic behaviors to successfully browse the procedure of acquiring charge card after insolvency.

Understanding the rigorous credit score card qualification requirements is important for people seeking to obtain debt cards after personal bankruptcy. While safeguarded cards provide a course to enhancing credit scores, unsafe cards supply more adaptability however might be more challenging to obtain for those with a struggling debt history.

In final thought, discharged bankrupts can acquire credit rating cards by meeting qualification standards, rebuilding credit, understanding the difference in between protected and unsafe cards, and applying purposefully.